The real time trading service is an in house solution for trade execution and risk management.

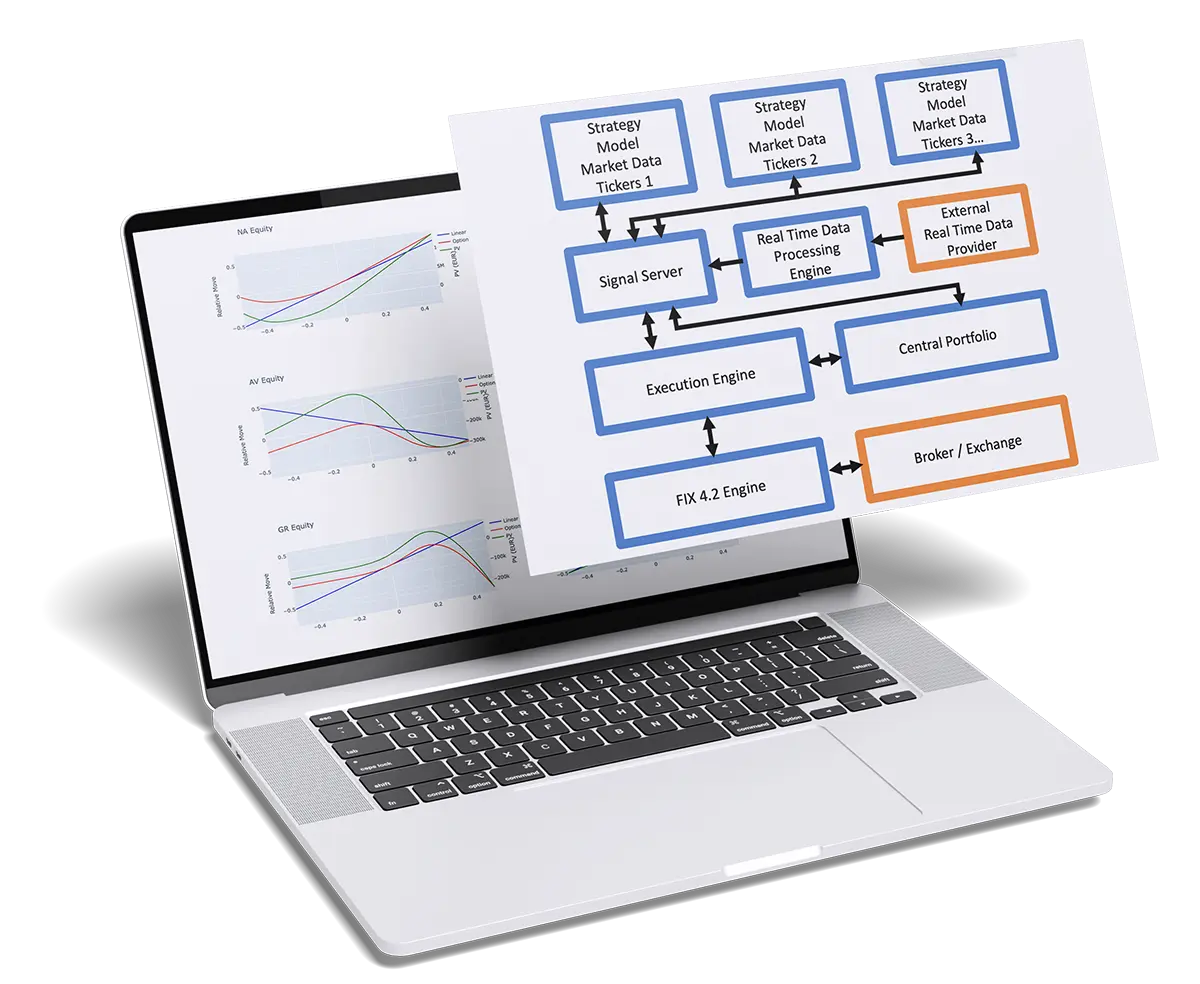

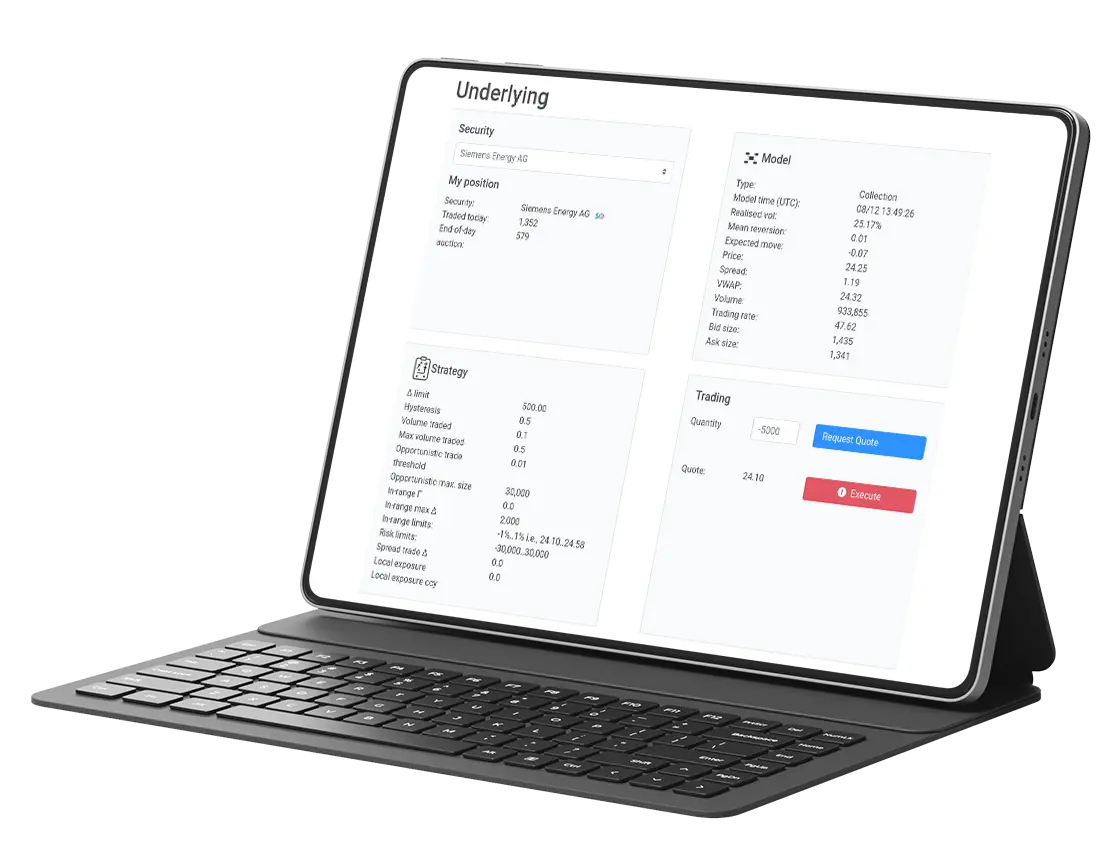

The execution engine is built in a modular and distributed fashion to ideally use computing resources and reduce latency. Several trading modules, running concurrently, will consume real time data and risk positions to place and review orders in the markets through a FIX 4.2 Engine. The underlying strategies and models, each responsible for a set of traded securities, can be calibrated to the idiosyncrasies of underlying names.

Models and Strategies have a common API, so new trading ideas can easily be implemented and tested in standard Python. Several models are available to choose from and extend as required.

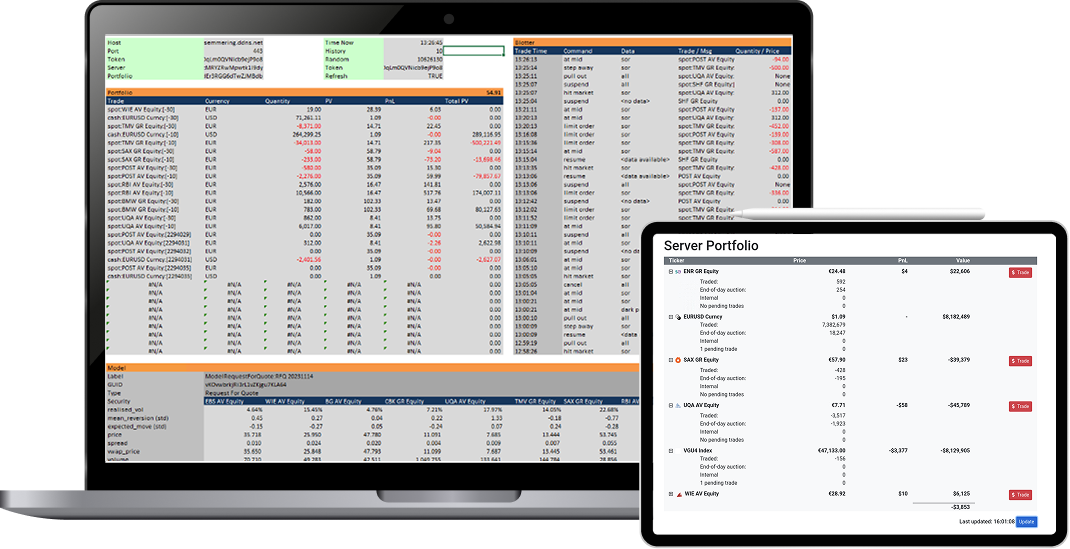

To monitor and interact with the trading service a restful HTTPS API is available. This can we used natively as well as through a PHP Web GUI and an Excel GUI. The Excel GUI is fully flexible and consists of a set of Excel Add-ins that can be configured and integrated into native Trading sheets if necessary. The restful API can also be called from in-house applications and is easily integrated into systems already in use. The API callable through a standard SSL web socket and is language agnostic.

The real time trading service can be configured to work with standard Portfolio Management Systems to automatically and dynamically aggregate and manage risk.

The engine can be configured to work with both Imagine RiskSmart+ and Enfusion Portfolio Management Systems (PMS) to dynamically manage intraday trading and risk as well as acting as a netting engine. Trades from various sources (individual traders, block trades, dynamic non-linear derivative risk) will be priced, netted and automatically hedged using both internal models and algos as well as broker algos. Managing and limiting total exposures, building and exiting positions as well as internal algos (range trading, spread trading etc.) are automatically managed at the same time. Dark pools, lit markets as well as market auction participation on several venues are supported.

The real time trading engine uses an execution service built around the FIX 4.2 industry standard (https://www.fixtrading.org). The FIX 4.2 implementation has been eternally certified by Bloomberg through the BBG FIXNet API as well as other major brokers. Broker specific configuration for several brokers is available within the Engine, and other brokers can be added easily if necessary. The Engine runs asynchronously and will message various market events (fills / cancel and replace / etc.) to the service using a standard data driven API. The Execution engine is modular and separate from the service and can be used elsewhere through the internal API. Comprehensive Unit tests are available to test full compliance to the FIX 4.2 standard.

The engine can trade common stock as well as index based and other futures.

The trading service comes with a dedicated back testing engine. This is designed to test both new models and strategies as well as calibration and configuration changes. The trading service is agnostic as to whether it is run in production or as a back test, so every change in code or configuration can be tested and is guaranteed to behave in the same manner when used in a live environment. Comprehensive logging can be produced as well as summary files across back testing dates and configurations.

The back testing environment can be interacted with in the same way as a production run. Runtime changes can be made through either the Web or Excel GUI as in the live environment.

The Real Time Trading Service is ideally suited to small funds who want to aquire a comprehensive front to back trading solution. The system is scalable and open, so new strategies and models and models can be easily added to the framework. Modular design of the software makes it easy for funds to implement and test their own strategies. The service can be hosted either on premise within customer infrastructure, as a containerised cloud service (AWS), or on premise at TARS Consulting.

If you are interested in a demo, or would like more information on the Real Time Trading Service, please contact us on info@tars-consulting.com.

To provide you with the best experience, we use technologies such as cookies to store and/or access device information. If you consent to these technologies, we may process data such as browsing behavior or unique IDs on this website. If you do not give or withdraw your consent, certain features and functions may be affected.